The use of second-hand clothing is gradually becoming established in the dressing room of French consumers. Despite its rapid growth, it now accounts for only 2% of the total weight of the fashion and luxury goods sector in the world.

However, according to a BCG study based on consumer data from Vestiaire Collective, this figure is expected to grow by 15 to 20% over the next five years.

Therefore, it is important to acknowledge what led consumers to switch to this type of consumption, but also at the characteristics of their second-hand purchases in order to better understand this practice.

Consumers get into the business by selling, not buying.

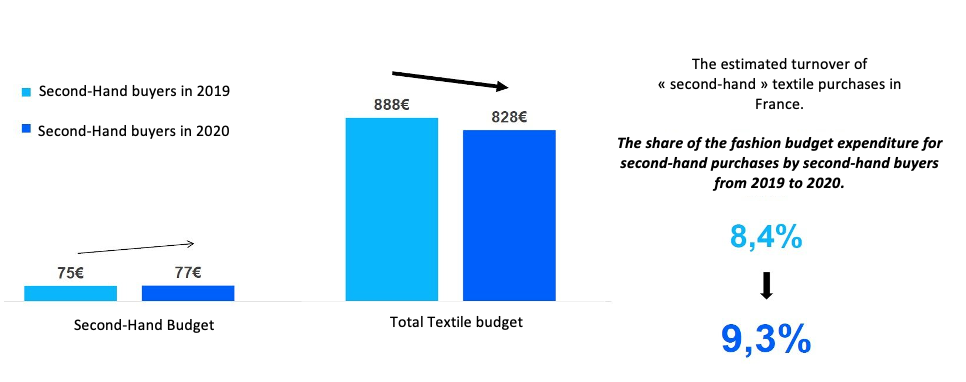

In the fashion budget of French consumers:

- Second-hand clothes represent 9.3% of their clothing expenditure in 2020.

- Increase in the budget for second-hand clothes – from 75 to 77 euros.

- Decrease in the general budget for clothing.

While 29% of French people buy second-hand clothes, 36% sell their old clothes, which represents 18.7 million people in 2019.

The practice of buying and selling second-hand clothes has been facilitated and democratised by the emergence of specialist online platforms. Vinted, Vestiaire Collective, Le Bon Coin, and others, have managed to become part of French people’s daily lives in recent years.

Covid-19: boost or stop?

According to Fevad and Kantar, quarantine has contributed to changing consumer habits in terms of online fashion:

- More time to sort your dressing room

- More time to buy and sell

- Growing popularity of second-hand items

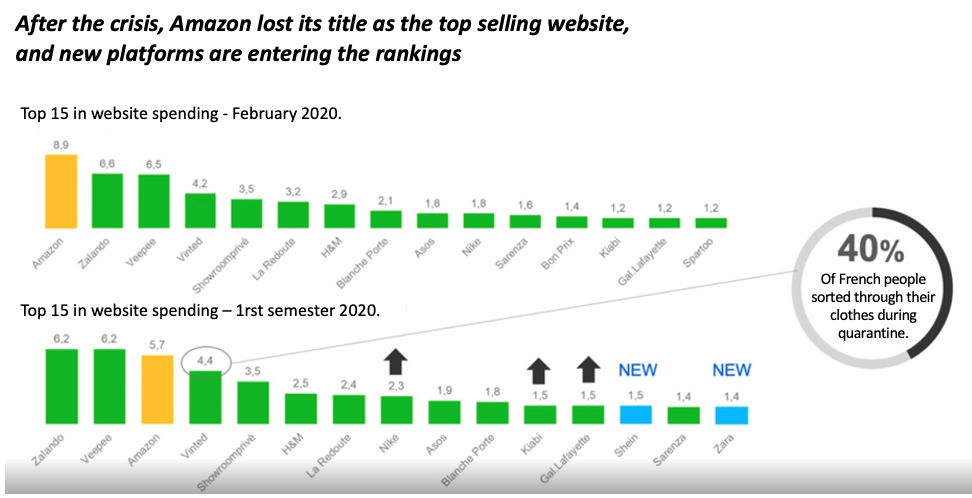

Vinted has made a stunning entry into the Top 5 most influential websites in the online fashion industry. Zalando and Veepee took over the leadership of online fashion with 6.2 market share value (MVP) each, leaving Amazon in 3rd place, according to Kantar’s Fevad x Worldpanel results.

However, it should be pointed out that the crisis has not spared the second-hand market. Indeed, according to Kantar, 29% of French people declared having bought second-hand goods this year, when 32% did in 2019. Hélène Janicaud, director of Kantar’s fashion division, specifies that the loss of customers is very limited compared to other industries.

Second-hand consumption has been impacted by several factors:

- The garage sales cancellation

- The closure of specialist shops (second-hand shops, Emmaus, etc.).

- The temporarily suspension of Vinted’s website

However, this decline is temporary, considering this is a well-established habit among younger people and that responsible consumption awareness is continuously growing.

Where have second-hand enthusiasts been shopping this year?

- 71% of French people who buy second-hand have bought an item on Vinted this year,

- 22% of converts found second-hand clothes on Facebook.

- Vestiaire Collective has raised 59 million euros to continue to expand its audience (+90% of male sellers in 2019).

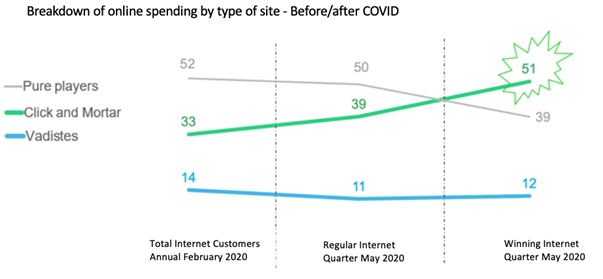

Concerning the channels used, online-fashion regulars prefer pure players (it represents 52M of their spending, compared to 39% for Click and Mortar, and 11% for online buyers).

However, Kantar notes a progression within cross-channel players such as Nike, Kiabi or Zara. The institute observes that, despite the reopening of the shops on 11th May 2020, after two months of quarantine, 17% of French people bought exclusively online between May and June 2020, only 3% did in 2019.

Who are the consumers of second-hand clothes?

According to Vinted, most likely to buy second-hand in the future are people under 35. The panellist Kantar claims that some of the youngest consumers are making a major change in their wardrobe, in which second-hand purchases are becoming more common than new purchases. Therefore, the younger generation is the one carrying this growing movement.

However, the people who are the most involved in this practice in France are:

- People living in regions and towns of less than 20,000 inhabitants

- More particularly women of 25-35 and families

According to Hélène Janicaud, there are various reasons why these consumers engage with second-hand fashion:

- The desire to spend less and save money (69%)

- Buying a lot at a lower price (37%)

- To be able to afford a good quality piece at an affordable price (35%).

The 50+ age group would be the most reluctant to this trend.

Beverly Sonego, founder of the high-end second-hand website ByLuxe, explains that second-hand fashion in luxury has reached an important tipping point. What was once a shame to have to go through second hand to be able to wear luxury goods has now become a proudly claimed act.

According to her, there is no longer a typical profile in luxury second-hand: all generations, regions and socio-professional categories are concerned. Second-hand has made certain products accessible (on average -50 to -60% on prices) and has thus opened the doors of luxury to new consumers.

So, is it a complement to purchase or a total alternative to new products ?

Thred Up, an American second-hand platform, estimates that, by 2028, vintage will be more consumed than fast-fashion in the United States. In this sense, more and more traditional brands and retailers in France and elsewhere are trying the second-hand service (cf. @Patatatam).

In an era carried by a generation denouncing an over-consuming society, and consciences focused on new ways of consuming, second-hand fashion could experience a real boom in the years to come. Therefore, it is a practice that businesses should take into consideration in order to respond to these new consumers’ demands and move towards a circular economy.

Sources :

- « La seconde main, un marché qui séduit toujours plus de clients », Marion Deslandes, 2020, Fashion Network

- « Vinted, champion de la seconde main, avale son concurrent néerlandais United Wardrobe », Matthieu Guinebault, 2020, Fashion Network

- « Duel Vepee, Zalando, Amazon arbitré par Vinted dans la mode », Mickaël Deneux, 2020, LSA Commerce Connecté

- « Le e-commerce a gagné plusieurs années de développement sur le marché de la mode », 2020, FEVAD

Do you want to know more about regenerative fashion & textile? You’ll surely find these articles interesting: